Stock Ideas: Yext vs. HubSpot

- Matt Wolodarsky

- Jan 18, 2020

- 10 min read

Updated: Mar 18, 2022

Two SaaS companies turning traditional marketing on its head. Which is the better investment idea?

After my recent post about how to pick tech stocks that deliver wealthy returns, I decided to put my methodology to the test with two recent stock ideas - Yext (NYSE:YEXT) and HubSpot (NYSE:HUBS).

Yext and HubSpot are two companies that are helping their customers adapt to the new world of digital marketing. Read on to see how these two stock ideas stack up against one another, and to get my bottom line for which one should get a second look.

To decide on what I believe is the better of the two investment ideas, I evaluate each below based on my characteristics of high growth potential tech stocks.

Yext (NYSE: YEXT)

Search has undergone a transformation. People want answers, not links. In this new world, companies need to ensure their brands are represented properly across the multitude of services (voice assistants, Instagram, Snapchat, Google) and devices (smart TVs, smart watches) consumers use regularly to interact with brands.

Brands don’t have control over these services and with all the misinformation and bad actors that pervade the Internet it is surprisingly quite common for these services to provide consumers with incorrect brand information. Yext helps companies ensure consumers are getting accurate information about their brands from the digital services they use throughout the customer journey.

The world of search has undergone a massive paradigm shift. People don’t just type in disparate keywords to find documents or pages that contain keywords; they ask very specific questions. With the natural language processing that Google and Baidu use, these leading search engines can understand the user's intent with their question and are to provide the best answer.

Consumers want accurate and relevant answers from their searches, the traditional 10 blue links that they used to get back from their searches are no longer useful enough. Increasingly, we also want our digital assistants (Siri, Google or Alexa) to not just provide answers, but also help us complete transactions. “Alexa – order me dinner from McDonalds”.

Businesses must find ways to control their brand across an increasingly disaggregated Internet. It used to be that consumers would rely on a company’s website as their main interaction with the brand. With the rise of digital services, such as voice assistants, Yelp, Uber, and Instagram, this is no longer the case. With numerous sources weighing in on a brand’s digital information (e.g., locations, menu’s, store hours, etc.) it is quite common for these digital services to provide misinformation. Businesses need a way to gain control of their brands across the internet by monitoring a company’s facts that are searched by hundreds of digital services. Yext helps brands ensure digital services are using accurate information when answering questions from consumers (“Google: What are the best Greek restaurants in my area”), or increasingly, complete the transactions their masters are asking of them (“Google: Get Uber Eats to deliver me dinner from nearby Greek restaurants that makes the best chicken souvlaki”).

It is a non-negotiable requirement for companies to ensure their brands, and their digital information, are being properly represented in today’s digital world. Yext helps companies do it at a lower cost to the alternative. There currently isn't an easy way for companies to keep tabs on and manage all this company digital information. Yext helps fill that gap.

According to Yext, their self defined market of digital knowledge management has an estimated total addressable market (TAM) of $20 billion. With 2019 annual revenue of $230 million Yext has a lot of runway to capture more of the total addressable market. Yext claims they have no competitors, so they feel they are in a good position to capture most of the TAM. Take all of this with a grain of salt as Yext is not a neutral observer in this case.

I was unable to find any major technology analyst firm, such as Gartner or Forrester that cover the digital knowledge management space. Yext formally lists their primary competitor as "businesses that choose to handle digital knowledge management in-house using manual processes”.

It appears there are some competitors who do portions of what Yext does (e.g., search engine optimization), but none that match the complete Yext portfolio of products. One of the most comprehensive stock analysis of Yext I’ve seen states “There are no competitors really. I can find companies with some overlap, but none that are comparable to Yext when it comes to the overall product quality, integrations, customers, and traction” - https://medium.com/@evanknowles/building-the-internets-brain-yext-b4d7e14877c6

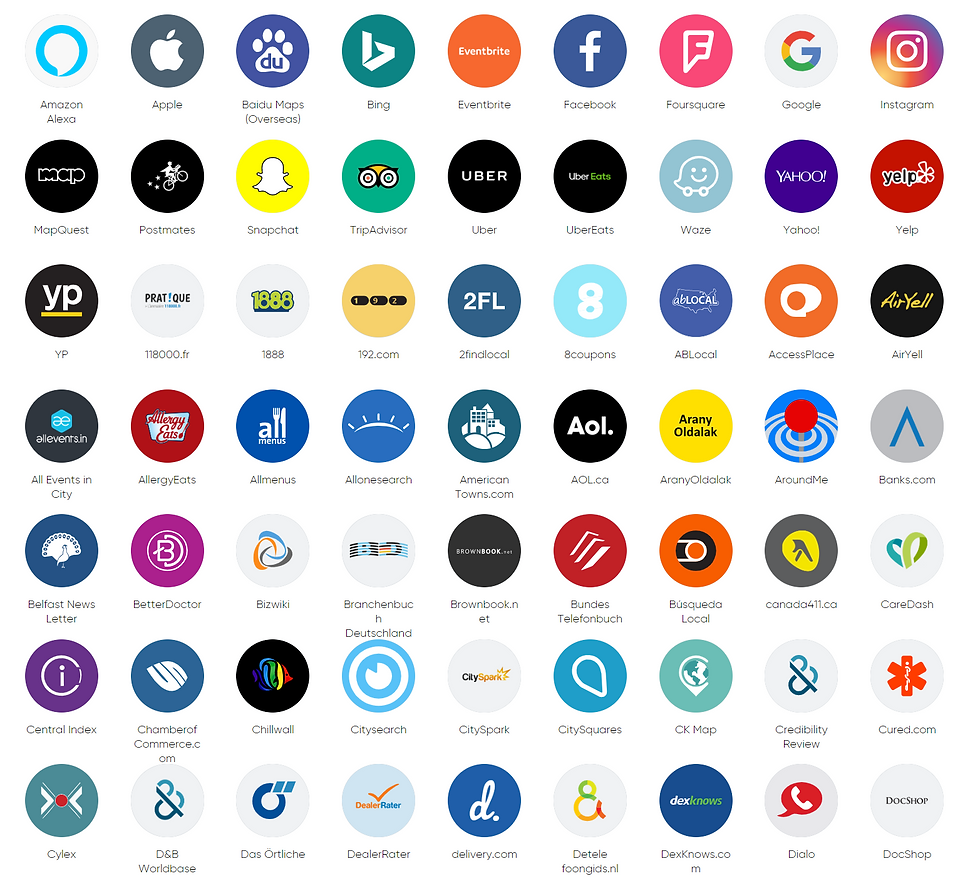

Yext has the most integrations with digital services (100+) and 1.5 million+ companies manage over 200M attributes of digital knowledge. Yext has a strong network effect in place that will make it hard for emerging competitors to steal share. This could also make them a good acquisition target for customer experience cloud vendors, such as Adobe, who are looking to expand their offerings.

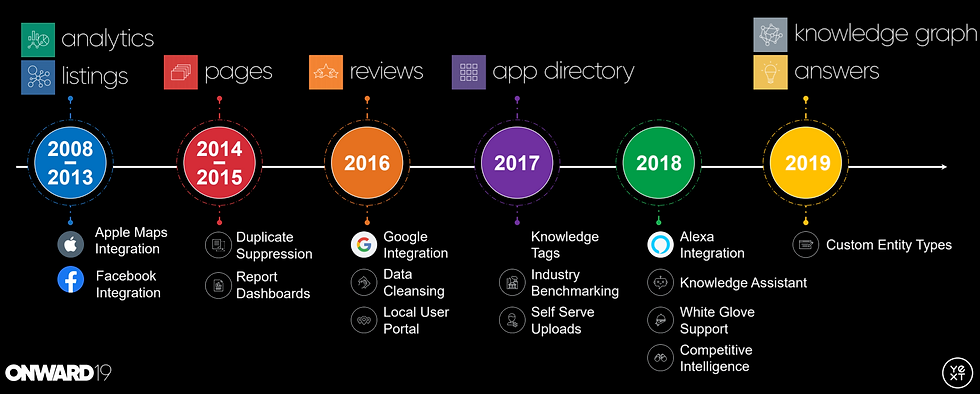

Yext has shown the ability to create new use cases, growing from their original listing product in 2013, adding pages in 2014, reviews in 2016, and the knowledge graph and answers in 2019. These new products have enabled Yext to grow their revenue footprint in existing customer accounts. One example Yext provided at their recent annual investor conference was a telecommunications customers that grew annual spend with Yext 18.8x over 4 years from $100K to $1.8M.

I have not seen a lot of information from Yext directly on what future markets they could enter, that’s understandable given they don’t want to tip their hand to competitors. It does leave me struggling a bit to see concrete, future use cases that will accelerate revenue growth significantly aside from continued international expansion.

Some opportunities I can envision for their technology includes exposing their knowledge graph for business to business (B2B) services. They are currently focused on business to consumer (B2C). The Internet of Things (IoT) trend could create an increasing need for connected physical objects to gain access to the Yext knowledge graph. One obvious examples is autonomous cars needing to know where all the Wendy’s or McDonalds’ are located. What about industrial equipment, what digital information will they require of their suppliers and customers? Controlling all that company digital information for providing answers and completing transactions seems like a tremendous asset that the company should be able to monetize further. I’m just not able to fully envision what they are, and I would like to see leadership provide a clearer picture of their longer-term vision.

At $1.72B in market cap, Yext is still very small, providing significant runway for future stock price growth. I can see Yext easily growing to be a $5B company, whether it will grow tenfold, or more is dependent on if its leadership can maximize its optionality.

While I’d like to see Yext ratings on Glassdoor be a little better,

they have filled in their leadership team quite adequately. A noticeable number of their executive team members are from Salesforce, another SaaS provider that knows a thing or two about growing into a multi billion-dollar juggernaut.

All data as of January 17th, 2020

HubSpot (NYSE:HUBS)

HubSpot pioneered a new form of marketing designed to adapt to how today’s modern consumer shops and buys. Inbound marketing has become a very cost-effective alternative to the traditional outbound marketing method.

HubSpot is the marketing cloud leader in the Small and Midsize Business (SMB) segment, can they compete in the enterprise?

As fellow graduate students at MIT in 2004, Hubspot co-founders Brian Halligan and Dharmesh Shah noticed a shift in the way people shop and buy. Consumers were no longer tolerating interruptive bids for their attention — in fact, they'd gotten really, good at ignoring them.

With this insight the co-founders created a transformative way to market called "inbound", the notion that people don't want to be interrupted by marketers or harassed by salespeople — they want to be helped. Inbound marketing empowers companies to stop interrupting their customers and start helping them.

The founders of HubSpot are not alone in the recognition that marketing is transforming. Gartner found in a survey that generating growth is the top priority for CEOS. In a Prsopex.ai survey of 750 decision makers, 58% of respondents indicated that lead generation is a key challenge business leaders face. Over 40% describe their current sales and marketing processes as “outdated”.

The inbound marketing Total Addressable Market (TAM) estimated by HubSpot in 2018 was $45B. In November 2019 HubSpot forecast their full year 2019 revenue to be $669 million to $670 million, representing 1.5% of TAM.

Inbound is becoming the new standard for marketing, every company will need to utilize it as part of their marketing mix. Today’s shopper, on average, does 70% of their research on a product on their own before contacting the company they are researching. Inbound marketing capitalizes on this trend by helping companies get found when consumers are looking. Inbound marketing has proved its ability to generate leads, drive sales and grow businesses. It is also less expensive then the alternative. Traditional outbound marketing forces companies to span a wide net to reach their target market at time of need. This means outbound marketing causes companies to overspend on marketing. Unlike outbound marketing, inbound enables companies to reach only those with interest in what they are selling, a far more cost-effective marketing investment.

In the Small and Midsize business (SMB) segment, HubSpot has the market leading solution. They invented the inbound marketing category and offer SMB customers the Rolls Royce of inbound marketing software. While HubSpot has made some inroads into the enterprise segment, they still lack some of the advanced features large enterprise customers require. They are however improving their standing in the enterprise market.

A barometer of enterprise software rankings, analyst firm Gartner has taken notice of HubSpot. In 2017 HubSpot did not even appear in Gartner’s Customer Relationship Management software, the larger segment inbound fits into, magic quadrant. In 2018 Gartner ranked them as a niche player, and in 2019 they improved to a challenger in the annual magic quadrant ratings. They are on the verge of cracking into the leader quadrant, rarefied air that Salesforce, Oracle and Adobe occupy.

According to Capterra, which ranks software providers according to customer reviews, HubSpot ranked higher than Salesforce in some key areas, including overall rating, ease of use, customer support. They do lag slightly behind Salesforce in features and functionality slightly.

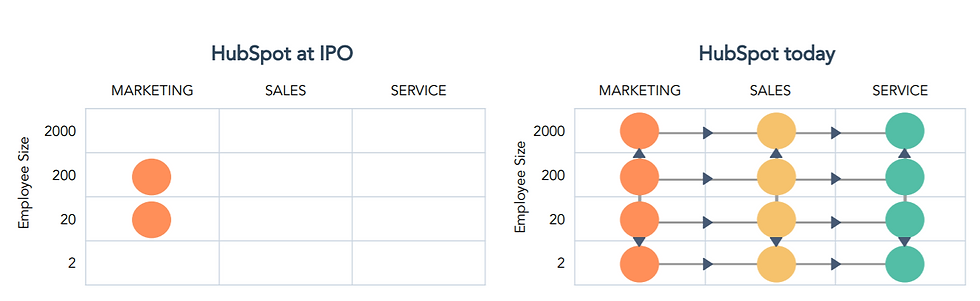

HubSpot has a proven ability to execute in order to realize the inherent optionality of its business. At time of IPO, HubSpot had a marketing app that was targeting the small to midsize business segment (SMB). They have since evolved into full suite, adding products (they call them hubs) for the sales and service functions.

While their service hub product is still nascent, sales hub is showing promising growth. In a little more than a year they have show real progress in upselling their customers to additional hubs. In this short period Hubspot went from most customers just adopting one of the “hubs”, to 37% of customers now adopting two and 6% of customers adopting all three.

HubSpot has also entered the enterprise market.

With increased investment to improve their enterprise offerings , they have doubled the number of enterprise customers from 4K to 8K in just 18 months.

Where is the future growth going to come from?

Adding new Hubs: At their 2019 annual investor’s meeting HubSpot shared that in the next 3-5 years they expect to add several new hubs. As to what hubs could be next, the only hint they’ve provided is that they will select new hubs that integrate well with existing ones. Decoding this, I would forecast others element of the customer journey being the next hubs that HubSpot releases. This could include hubs that help companies better manage their reputation online (e.g., monitoring and managing reviews, social conversations, etc.), engage in direct to consumer purchases (watch out Shopify?), customer retention, and customer advocacy.

Artificial Intelligence: HubSpot speaks a lot about removing friction from the customer experience, so another area of monetization could be adding more Artificial Intelligence to their stack.

Platform: HubSpot has ambitions to further grow and monetize their platform for third party developers to extend and build on top of HubSpot. There are currently 300+ apps built off HubSpot. They see opportunity to add new marketplaces (e.g., templates, forms) and further monetization (insert optionality graphic).

Enterprise: HubSpot is one of the top, if not top, marketing suite option for SMB and mid-market customer. They have not gained as much traction in the enterprise customer segment. They haven’t quite reached the level of being able to compete with SalesForce in the enterprise. A couple of years ago HubSpot had a very noticeable product outage, which in the enterprise space can be hugely detrimental when trying to prove yourself, not that SMB customers don’t care. Security, infrastructure, reliability and performance are table stakes to win in the enterprise. There is no room for compromise in these critical areas with enterprise customers. It is encouraging to hear HubSpot share they are heavily investing and transforming their product development processes to be more enterprise ready. Only time will tell if they are successful in building their enterprise business. It’s a bit of a question mark for me.

With a current market cap of $7.5B, HubSpot may not have as much upside as the smaller Yext, but there is less risk in their ability to double in the next three to five years; relative to Yext being able to grow 5 – 10 times in the same time period.

CEO Brian Halligan is highly regarded by HubSpot employees. In 2019, Glassdoor ranked him as #16 on its list of top CEOs with an employee rating of 98%. Out of thousands of CEOs that’s very impressive. Top marks for HubSpots leadership.

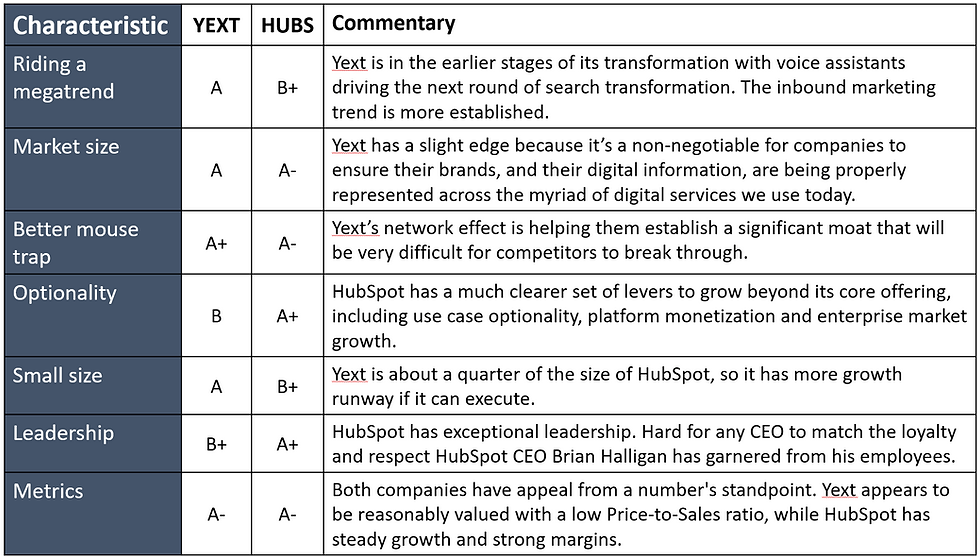

Winner: Yext vs. HubSpot

Let's look at how these two marketing SaaS companies stack up to one another.

My Bottom Line

Winner: HubSpot

I believe HubSpot is the better bet – they have a solid track record of growing the company beyond its first act, with plenty of options to continue to grow the company at an impressive rate. Their leadership is excellent and they have more certainty than Yext. HubSpot on the other hand is a proven player in a market they pioneered with plenty of options to continue their steady growth. I decided to invest in HubSpot and got in at $181.72 on January 17th, 2020.

As with any investment decision you make it’s important to complete your own due diligence and assess if the investment matches your risk profile. Like any individual stock there is risk.

These two stock ideas fall into the category of "taking intelligent risk". I don't do this often but I believe with the right investment hypothesis, research and buying what you know; allocating a small portion (i.e., 5% of your portfolio) of your total investment portfolio to taking measured risk can be worth it for the potential of hitting the odd home run that super charges your returns. Before making investment decisions please do your own research and/or seek the advice of a professional adviser.

Comments