Guide to Dividend Growth Investing

How to be Successful at Dividend Growth Investing

Now that we’ve established dividend investing is worth getting good at, our attention can turn to how to be successful at it.

Not surprisingly, dividend investing is not that much different than other forms of investing. The fundamentals still matter with dividend investing – having a good hypothesis for your investment, allocating wisely, and diversification. Don’t fall into the trap of focusing too much on income potential to the determinant of these other important considerations.

Portfolio allocation

How much of your total investment portfolio should you put into dividend paying companies? A lot of this is going to come down to your risk tolerance and what stage of the investing journey you are in. If you are overly risk adverse, or if you are in your retirement years, you would likely put more of your new money into fixed income assets.

With many years ahead of me before I retire, the calculus is straight forward in my mind. Why wouldn’t I over index on an asset class (i.e., dividend paying companies) that has outperformed the S&P 500 over a 55-year period and can be a significant source of income in my retirement years. Here is the breakdown of my investment portfolio allocation and how much of my capital I’ve put towards dividend paying companies:

Individual dividend paying equities vs. Exchange Traded Funds (ETFs) vs. Mutual funds

You may be saying to yourself “I see the upside in dividend investing but I don’t have the time to do the research necessary to make informed selections of specific dividend paying stocks”. This level of self honesty not only serves you well in life but with investing as well. If you are not able to dedicate the time necessary to research and monitor your stocks (or hire an advisor to do that on your behalf) than it’s critically important to adopt an investment style that is suitable – in this scenario that would be the “Couch Potato Investor” which means using dividend focused ETFs or mutual funds to achieve your financial goals, rather then trying to pick individual stocks.

There is a lot of debate about which is the better investment option - ETFs or mutual funds. Type ETFs vs mutual funds into Google and be prepared for a lack of consensus and in some cases biased viewpoints. I’ll save you from the debate and just share my two cents on the matter. About 10 years ago I switched all mutual funds I owned to ETFs primarily because of the high fees associated with mutual funds and the lack of market beating (or in too many cases a lack of even market meeting) returns realized by most mutual funds. Why pay the higher fees of mutual funds for what seemed like sub par performance. There are mutual funds that are worth their fees, but I always found it difficult to find mutual fund managers I could trust to beat the market over the course of my investment horizon. I was able to achieve my diversification goals with ETFs and get more dependable returns rather than trying to

pick the best mutual fund managers in the world.

You can find several top ETFs or mutual funds for dividend investing lists, including Investopedia’s Ten Top Equity Dividend ETFs for 2019 and the Kiplinger 4 Best Mutual Funds for Dividend Investors. Do your research and select what is most appropriate for your age, risk tolerance and other important factors.

As you can probably guess by now, I mostly rely on selecting individual dividend paying companies for my own investment portfolio. I believe that with the right amount of interest, time and research you can successfully select individual dividend paying companies that will help you realize market beating returns with the potential to accelerate your path to financial freedom. But, with great reward comes risk; so be honest with yourself and choose the best approach for your situation.

Diversification – Sectors and Geographies

While identifying, researching and selecting individual dividend paying companies that generate growing income can be quite thrilling, you still need to think of the big picture. You are not just selecting stocks randomly; you want to manage a successful dividend portfolio that protects you against market risk and insulates your income stream from any one individual company cutting its dividend. You just have to think back to the great recession of 2008 and 2009 when the entire US financial services sector, traditionally major dividend payers, had to cut their dividends (or eliminate) just to survive. Only diversification would have saved you from being overly dependant on an entire sector that had a long legacy of large and growing dividend distribution at that time.

With over 11 major sectors making up the stock market (e.g., energy, materials, health care, financial, information technology, etc.) there are several options to achieve diversification. Just because you can invest in each of the 11 different sectors for the purposes of diversification doesn’t mean you should. Some of these sectors carry with them a disproportionate amount of risk and low yields. For example, I avoid the materials sector altogether because of its volatility. My decision to avoid the energy sector is based on my personal belief that over the long run sustainable energy sources will replace more traditional sources, bringing new industry titans that are difficult to identify at this stage. I believe this transition will take some time so I acknowledge my precaution may be a little premature.

Let’s look at the different industry sectors that provide good dividend opportunities. I am not necessarily recommending the companies listed in my sector analysis below, they have been provided for example purposes.

Telecommunications

One of the more traditionally strong dividend industries is telecom. Telco companies typically offer high dividend yields, but minimal growth. Telco’s generate a fair bit of cash flow, making it easier for them to pay dividends. Participating in a more mature sector of the economy leaves telecom companies with fewer high return internal projects and ample cash to redistribute to shareholders thru dividends. Lots of telecom companies to pick from, including AT&T (T), Verizon (VZ), BCE (BCE), and Telus (T).

Financial Services

While the 2007-2008 financial crisis forced many US banks, who had been raising dividends year after year, to make cuts – there are many good options in this sector. If you are now gun shy towards US banks despite the recovery allowing them to now return to their tradition of growing dividends, you should consider non bank financial services companies that are well managed such as investment management firms Blackrock (BLK) and T.Rowe (TROW).

Another option is Canadian banks such as TD, Scotiabank and Royal Bank. Canada more strictly regulates its banks, relative to the US, protecting them from themselves in times of economic crisis. Canadian banks operate in an oligopoly, are well managed and very profitable, attributes that have allowed them to pay dividends consistently since the early to mid 1800s.

Health Care

Health care benefits from an aging population in developed markets and it offers respite from recessions as people will always require health care. Health care is also a great sector to find high-quality dividend growers. There are currently 6 companies in the health care sector that have 25+ years of consecutive annual dividend increases.

One of my favorite dividend stocks overall, Johnson & Johnson (JNJ) has raised dividends annually for the last 56 straight years. Another popular health care company Abbot has raised its dividend for 45 years straight and hasn’t missed a dividend payment for 95 years in a row.

Industrials

The industrials sector is often an after thought for many investors, but they can be a source of solid companies with an appetite for rewarding their shareholders with growing dividends. In fact, there are seven industrial sector companies that have a track record of over 50 years of consecutive dividend increases. This includes companies such as Emerson Electric (EMR), Dover Corporation (DOV), 3M (MMM), and Stanley Black & Decker (SWK).

You will find a lot of industrial companies that have been around for a long time, which can help with finding companies that have built up a dependable business over the years. While you may have more time to react and minimize loss with industrials as compared to other sectors, examples like General Electric (GE) remind us we cannot take our hands off the wheel entirely even within a steady sector such as industrials.

Consumer

Made up of staples and discretionary based companies, the consumer sector includes brands you and I encounter every day. Consumer staples may offer a little more protection during times of recession as companies like General Mills (GIS), Hanesbrands (HBI), and Campbell Soup (CPB) make goods that remain in demand during any economic period, including during recessionary times. While technically not required everyday goods, companies like Starbucks (SBUX) and Amazon (AMZN) have built such strong brands that for some of us they have become everyday products and services for all intents and purposes.

Information Technology

Not traditionally thought of as a source for dividend paying companies, the information technology (IT) sector now has a growing number of reliable dividend payers, including IBM (IBM), Intel (INTC), and Cisco (CSCO). An increasing number of tech companies, like Cisco, are new to dividend distributions but have made up for it with aggressive annual increases. Cisco started paying dividends in 2011, and with their annual increases its dividend is now 11X what it was in 2011. Tech companies have some of the highest dividend growth rates relative to other sectors.

As companies in the tech sector mature, they are more likely to turn to dividends to reward their shareholders in lieu of the accelerating double digit growth they may have delivered in their earlier days. Sooner or later the law of large numbers kicks in and tech companies need to look beyond stock price appreciation to provide shareholder value.

Utilities

Utility stocks tend to have better than average yield with little to moderate levels of risk, making them a favorite for dividend investors. The reason for these dynamics is the heavy government regulations imposed on utility companies, resulting in consistent and large dividends. Fortis (FTS), Enbridge (ENB), and Consolidated Edison (ED) are well known utility names in the Canadian and US markets.

Real Estate Income Trusts (REITs)

A good way to boost your portfolio’s yield, Real Estate Income Trusts (REITs) often offer the highest yield as compared to other sectors. The reason for this is as a commercial real estate portfolio that receives income from a variety of properties, REITs must distribute most of the income it generates to shareholders in order to qualify as a REIT.

Rather than select individual REITs I have chosen to invest in REIT ETFs. In recognition of my lack of knowledge of this space and therefore inability to properly assess individual REITs I prefer to benefit from real estate income through the diversification that ETFs offer. The REIT ETFs I own include iShares Global Real Estate Index (CGR) and the Canadian BMO Equal Weight REITs Index ETF (ZRE).

Foreign dividends

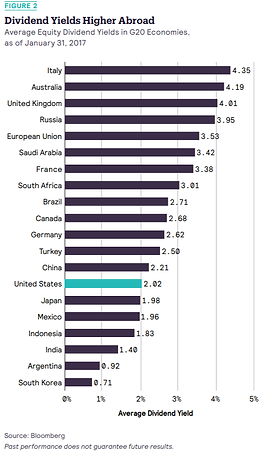

To further diversify investors should look overseas for foreign dividends. Many international stock markets average dividend yields that are higher than the U.S. and Canada.

Beyond high yield the best markets for dividend investors are those that have political and economic stability and good corporate governance. For example, Australia, United Kingdom (to a lesser extent these days with the disruption of BREXIT looming over the region), and other parts of Europe fit the bill.

Many of the big foreign dividend stalwarts you would come across in your own research, companies such as Unilever, GlaxoSmith Kline, Diego, Nestle, and Royal Dutch Shell (RDS), are all global business that offer diversification outside of the foreign counties they are listed in.

Given the global nature of our economies, it is a wise strategy to diversify our dividend income streams beyond the US and Canada. Just remember to consult with your accountant about the tax implications of holding foreign equities that pay a dividend as many foreign governments withhold a portion of dividend payments that could be reclaimed.

Sources for dividend ideas

I typically start looking for good dividend ideas by reviewing a regal set of companies in the world of dividend investing. This includes Dividend Kings and Dividend Aristocrats, which are a set of companies that have 50+ years and 25+ years of annual dividend increases respectively.

While not yet of monarch or high-class status, there are also a whole slew of titles used to describe an emerging set of dividend payers. A simple Google search will turn up several online sources that keep an up to date list of the constituents in each of these classes.

There are also several resources available to help you find and evaluate dividend paying companies. Here are some of my favorite bloggers.

Best blogs about dividend investing

My Own Advisor (https://www.myownadvisor.ca): Run by Mark Seed, My Own Advisor covers Mark’s journey on the road to what he describes as Financial Independence Work on Own Terms (FIWOOT). Mark covers a wide range of topics critical to achieving financial independence related goals, including his plans to generate $30,000 per year in dividend income.

Dividend Growth Investor (http://www.dividendgrowthinvestor.com): A frequent poster, the Dividend Growth Investor is a long term buy and hold investor who focuses on dividend growth stocks. A good mix of concept articles (e.g., Investing is part art, part science) and dividend company recommendations and analysis. The Dividend Growth Investor offers comprehensive analysis that is always well researched and current.

The Dividend Guy Blog (https://www.thedividendguyblog.com): Following an investing philosophy that is quite similar to mine, Mike the owner of The Dividend Guy Blog, focuses on buying and holding a set of traditional dividend stocks, with a portion of his portfolio dedicated to stocks poised for strong growth over a 18 to 24 month period. You can get started quite easily, literary, by selecting the “Start Here” link or downloading the helpful Dividend Growth Kit.

Dividend Growth Investing & Retirement (https://www.dividendgrowthinvestingandretirement.com): Take your dividend growth investing to the next level with the Dividend Growth Investing & Retirement blog. Best known for the Canadian Dividend All-Star List , DGIR also offers regular blog posts and its own dividend portfolio.

Million Dollar Journey (https://www.milliondollarjourney.com): While there are many bloggers who post about their own personal journey to various net worth or financial independence goals, none do it quite like the Million Dollar Journey. After achieving his goal of reaching $1M in net worth at age 35, the Frugal Trader – owner of Million Dollar Journey, has moved on to a new goal of generating $60,000 per year in dividend income by age 41. . The Frugal Trader shares his strategies and advice to help his 30K+ email subscribers achieve their financial goals.

Investment Talk (https://spbrunner.blogspot.com/) – This blog focuses on comprehensive analysis of various dividend paying companies. When I say comprehensive, I really do mean it. Leaving no stone unturned SPBrunner analyzes earnings, everything about the dividend and its sustainability, valuation, and even summarizes 3rd party analyst perspectives. Blogging consistently since 2008, SPBrunner covers a wide range of Canadian dividend stocks over a long period of time.

Building the idyllic dividend portfolio

Assembling the ideal dividend portfolio is a lot like building a world series winning baseball team with the right mix of wily and dependable veterans and up and coming young stars who still have a lot of growth ahead of them before reaching their full potential. The ideal dividend portfolio comprises the right mix of dividend veterans with limited growth prospects (e.g., 2% - 4% annual growth) that are compensated for with high yields (e.g., 3.5% - 5%) and emerging dividend stars that offer high dividend growth rates (e.g., 6%-10% annual growth) at the expense of lower dividend yields (e.g., 1.5% - 2.5%).

The result is a high-yielding, dividend-growing portfolio that will give you dependable yield from your veterans and year over year improvements from your emerging stars.

Turbo charge your dividend returns –Dividend Re-Investment Program (DRIP)

Would you be the type of person to quit your job and blow through the majority of your winnings from a lottery, if you were so lucky to win? Or, would you take a nice two week vacation to celebrate and return to work with a smile on your face knowing you invested all of your winnings wisely to set you and your loved ones up for one sweet and early retirement? Guess which type of person wins in the long marathon of meaningful and sustained wealth creation?

As you start to build up your own dividend portfolio you can either spend the dividend income it generates or re-invest it.

The way you re-invest the dividend income, in an automated manner, is through something called DRIP. No, DRIP has nothing do with those dreaded beads of sweat that start to drip from your armpits through your shirt on a hot or pressure filled day. DRIP stands for Dividend Reinvestment Plan and they have a significant impact on the amount of wealth you can accumulate over time.

They way DRIPs work, if you opt in, is they reinvest the dividend income automatically at the prevailing stock price. DRIPs make it easy for you to automatically reinvest your dividend payment into the purchase of new shares in the company. Don’t worry. This won’t be done without your consent, although for the security of our societies golden years I sometimes wish this was the case.

I love DRIPs, and you should too, for three main reasons:

-

Forced savings: DRIPs are one of the most powerful ways to automate wealth accumulation over a long period of time, they automate savings and investment like no other strategy. DRIPs remove emotions from investing due to their mechanical nature. Emotions and investing do not mix well when it comes to building sustainable wealth.

-

The compounding effect of investing on steroids: While it did take Albert Einstein to proclaim compound interest as the greatest mathematical discovery of our time, once you start DRIP-ing you will be able to plainly see how DRIPs can further boost your returns and supercharge the compounding effect of investing.

-

Dollar-cost averaging: DRIPs are an easy way to institute the popular investing strategy of dollar-cost averaging. This strategy allows the investor to buy a fixed dollar amount of a particular investment on a regular schedule (in the case of DRIPs when the dividend is paid), regardless of the share price. Dollar-cost averaging helps you reduce the downside risk of investing and DRIPs enable it.

How Do I DRIP?

Now that you are convinced of the pay-off of dividend reinvesting, how do you do it? Well, first you must choose solid companies to invest in that have DRIPs. Once you have invested in the right companies for you, setting up a DRIP is quite straightforward. You can either ask your broker to enroll you into what’s called a synthetic DRIP where the brokerage takes care of everything, or you can enroll into the DRIP directly with the company sponsoring it. I have opted to rely on my broker for synthetic DRIPs and while I recognize DRIPs offered by brokers are not the same as DRIPs offered by the company paying the dividend, I have chosen efficiency and simplicity over what I believe to be small incremental advantages of direct DRIPs. Learn more by reading this great post on The Million Dollar Journey blog about How Regular and Synthetic Dividend Reinvestment Programs (DRIP) Work.

What is the payoff for using DRIPs as part of your investing strategy?

A Rite of Passage Tale

Like most Jewish boys growing up in North America I went through my rite of passage into adult responsibility at the ripe age of 13 with the celebration of my Bar Mitzvah. Aside from symbolic recognition of a Jewish boy taking responsibility for his moral and spiritual conduct, the Bar Mitzvah can also be a relative cash bonanza for a young man. How the young man decides to manage the cash windfall a Bar Mitzvah brings is the first real test of the young man’s moral conduct. Many proud parents will leave a portion of the Bar Mitzvah cash gifts available, after putting some away for university, for their newly minted young man to manage. It is the first real encounter a Jewish kid has with the freedom money can bring. To spend or not spend (and save) is the question. My Bar Mitzvah windfall was $3,000, a lot of money even for a 13-year-old man😉.

Let’s see what the impact would have been for me had I had the foresight at 13, a rather unreasonable expectation, to invest into a dividend paying company and participate in their DRIP. We will use one of my favorite dividend paying stocks TD Bank (TSX:TD) to illustrate the impact of adopting the DRIP strategy for the $3,000 Bar Mitzvah purse. The two scenarios to be examined over a 25 year period (initiating the $3,000 investment in TD Bank in 1988 through 2013) are i) opting into TD’s DRIP and ii) collecting the cash from the dividend payment rather than re-invest it.

As depicted below, this $3,000 TD Bank investment over this 25 years period would have grown to $81,000 with dividend re-investment versus $47,000 if I had just collected my dividend without re-investment. Said another way, in this example, my annualized return over 25 years as a participant in TD’s DRIP would have been 104%, versus 59% as a non-DRIP participant. Not only does this highlight how amazing TD Bank has performed as an investment over the last 25 years, but it highlights the incredibly powerful compounding effect DRIPs have over a long period of time.

The dividend income snowball

Dividend investing (with DRIP) offers a very powerful compounding effect. Much like a snowball rolling down a snow-covered mountain, getting bigger and bigger; dividend investing offers similar physics. When you invest in dividend paying companies, that grow their dividend payments annually, and re-invest the dividend income back into the stock you have in essence created the financial equivalent of the snowball effect. The three force multipliers of dividend investing - realized dividend yield, dividend growth and dividend re-investment; when activated cause your investment to grow at an accelerated rate. Yes, snowball physics can be applied to investing and used to achieve financial freedom.

Force Multipliers

The dividend income snowball in action

Realized Dividend Yield: The dividend yield is the percentage amount of dividend income a stock is generating based on the price you paid for its shares. But this is just the starting point. What matters over time is your realized yield. The realized yield reflects your baseline dividend income at the time you purchased a stock, plus any subsequent changes the company may have made to the annual dividend amount and changes in the stock price. Hopefully, in both cases an increase.

Dividend Growth: The growth in the annual amount a company pays in the forms of its dividend can be a major accelerator. Using TD Bank (TD) as the example, let’s see what the impact of dividend growth over a 10-year period from the time I purchased TD in 2009 is on the realized yield.

My realized dividend yield with TD today is 9.8%. This is calculated by dividing the current annual dividend amount ($2.96 – as of August 2019) by the $30.23 price I paid for the stock 10 years ago. Compare this realized yield of 9.8% to the current yield (August 2019) of 3.94%.

It took me 10 years to triple the yield from what I was receiving at time of purchase to what I receive today. The power of time on your investment results strikes again.

Dividend Re-Investment: Re-investing your dividends back into the original investment that generates them is a powerful way to take advantage of the compounding effect. As you automatically acquire new shares through the investments DRIP, you’ll receive a slightly larger dividend payment. And the snowball gets bigger and bigger.

What happens when we activate all three of these mighty forces as part of our dividend investing strategy – realized dividend yield, dividend growth and dividend re-investment?

Let’s compare two scenarios to measure the long-term impact of the dividend income snowball: A) a yield only investment with no dividend growth nor reinvestment, and B) a dividend income investment that snowballs thanks to the leverage of all three force multipliers.

The common assumptions made for the two scenarios include:

-

$3,000 initial investment

-

25-year investing period

-

10% annual growth rate of share price

The dividend income snowball portfolio outperforms the yield only portfolio with:

• An additional $22,840 in portfolio value (as compared to year 25 value of the yield only portfolio)

• 65% better total return

The dividend income snowball is an incredible wealth creation machine that turns old money into new money. Even better, it does this without me lifting a finger.